oklahoma franchise tax mailing address

Oklahoma City 2501 North Lincoln Boulevard 405 521-3160 Tulsa 440 South Houston 5th Floor 918 581-2399. While all corporations must file a report with the.

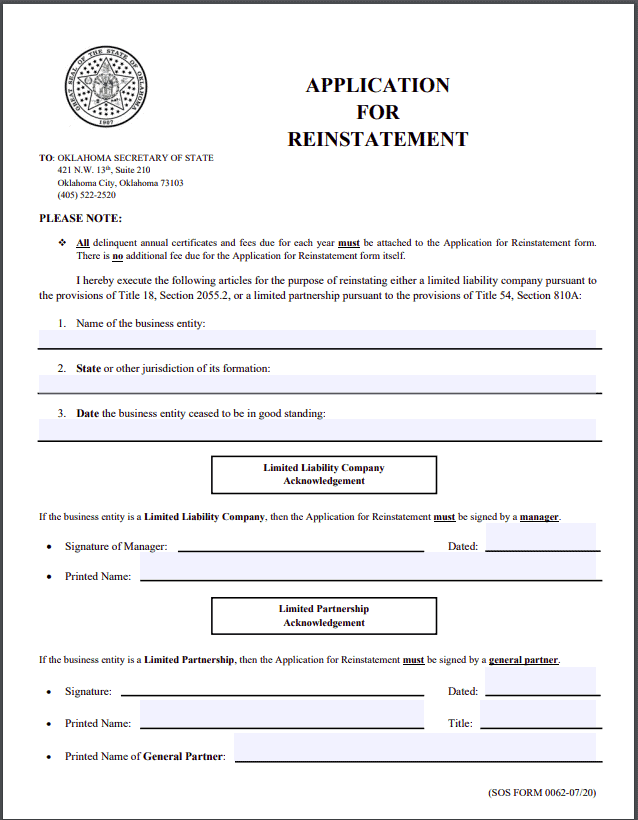

Free Guide To Reinstate Or Revive A Oklahoma Limited Liability Company

Oklahoma Tax Commission Post Office Box 26920 Oklahoma City OK 73126-0920 Back to top.

. And you ARE NOT ENCLOSING A PAYMENT. Franchise Tax Board PO Box 942840 Sacramento CA 94240-0040. For purposes of filing 2013 franchise tax return all.

Our mailing addresses are grouped by topic. Oklahomas franchise tax suspension has ended. Inclusion of Officers Is Mandatory.

Box 26930 Oklahoma City OK 73126-0930 Mandatory inclusion of Social Security andor Federal EmployerÕs Identification numbers is required on forms filed with. For a corporation that has elected to change its filing period to match its fiscal year the franchise tax is due on the 15th day of the third month following the close of the corporations tax year. Use of Federal Employer Identification Numbers and other identification numbers mandatory.

Returns should be mailed to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800. Oklahoma secretary of state 2300 n. Mark the post that answers your question by clicking on Mark as Best Answer.

Incorporators have to include their names and mailing addresses. Say Thanks by clicking the thumb icon in a post. Incorporators dont have to be directors officers shareholders or anyone with ownership interest in the corporation.

Only Mailing Addresses are currently available to add or change online. Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001. Oklahomas franchise tax suspension has ended.

Main Street Suite 1700 Wichita Kansas 67202 Search our websites. Our mailing addresses are grouped by topic. To make this election file Form 200-F.

Please include Social Security Numbers of officers. Oklahoma Tax Commission Franchise Tax PO. If you hire us well be your incorporators.

FISCAL YEAR AND SHORT PERIOD RETURNS. Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma City OK 73126-0930 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers Identification numbers is required on. Form Without payment With payment Other correspondence.

Oklahoma franchise tax is due and payable each year on July 1. Oklahomas franchise tax is a tax on corporations for the privilege of. You can find where to mail your Oklahoma State Return here.

1 Toll Free Phone Sales Tax Department. In Oklahoma the maximum amount of franchise tax a. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return.

Oklahoma Tax Commission PO Box 26850 Oklahoma City OK 73126-0850 Local Phone Sales Tax Department. The franchise tax applies solely to corporations with capital of 201000 or more. Oklahoma Tax Commission Franchise Tax Post Office Box 26920 Oklahoma City OK 73126-0920 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers Identi-fication numbers is required on forms filed with the Oklahoma Tax Com-.

General Oklahoma Tax Commission Address. 540 540 2ez 540nr schedule x. Corporations are taxed 125 for each 1000 of capital invested or otherwise used in Oklahoma up to a maximum levy of 20000 foreign corporations are assessed an additional 100 per year.

To add or change a location address fill out form BT-115-C-W and mail to. Eligible entities are required to annually remit the franchise tax. Eligible entities are required to annually remit the franchise tax.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types Income Tax Corporate Sales Use Withholding Alcohol Tobacco Miscellaneous Business Sales Tax Business Use Tax Business Motor Fuel. The filing is due July 1 2014 for the June 30 2015 period.

Oklahoma levies a franchise tax on all corporations or associations doing business in the state. The franchise tax applies solely to corporations with capital of 201000 or more. In oklahoma the maximum amount of franchise tax a corporation can pay is 20000.

Current Officer Information NOTE. 540 540 2EZ 540NR Schedule X. When is franchise tax due.

Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001. And interest for late payments of franchise tax 100 of the franchise tax liability must be paid with the extension. 7 rows If you live in OKLAHOMA.

Please include your return payment balance sheet and schedules A B C and D. And you are filing a Form. The franchise tax is calculated at a rate of 125 per 1000 of capital employed in or apportioned to the businesss outpost in Oklahoma.

Mail this return in the enclosed envelope. The filing is due July 1 2014 for the June 30 2015 period. What is Oklahomas Franchise Tax.

Oklahoma Secretary Of State Ok Sos Business Search Secretary Of State Corporation Search

Oklahoma State Tax Information Support

Where S My Refund Oklahoma H R Block

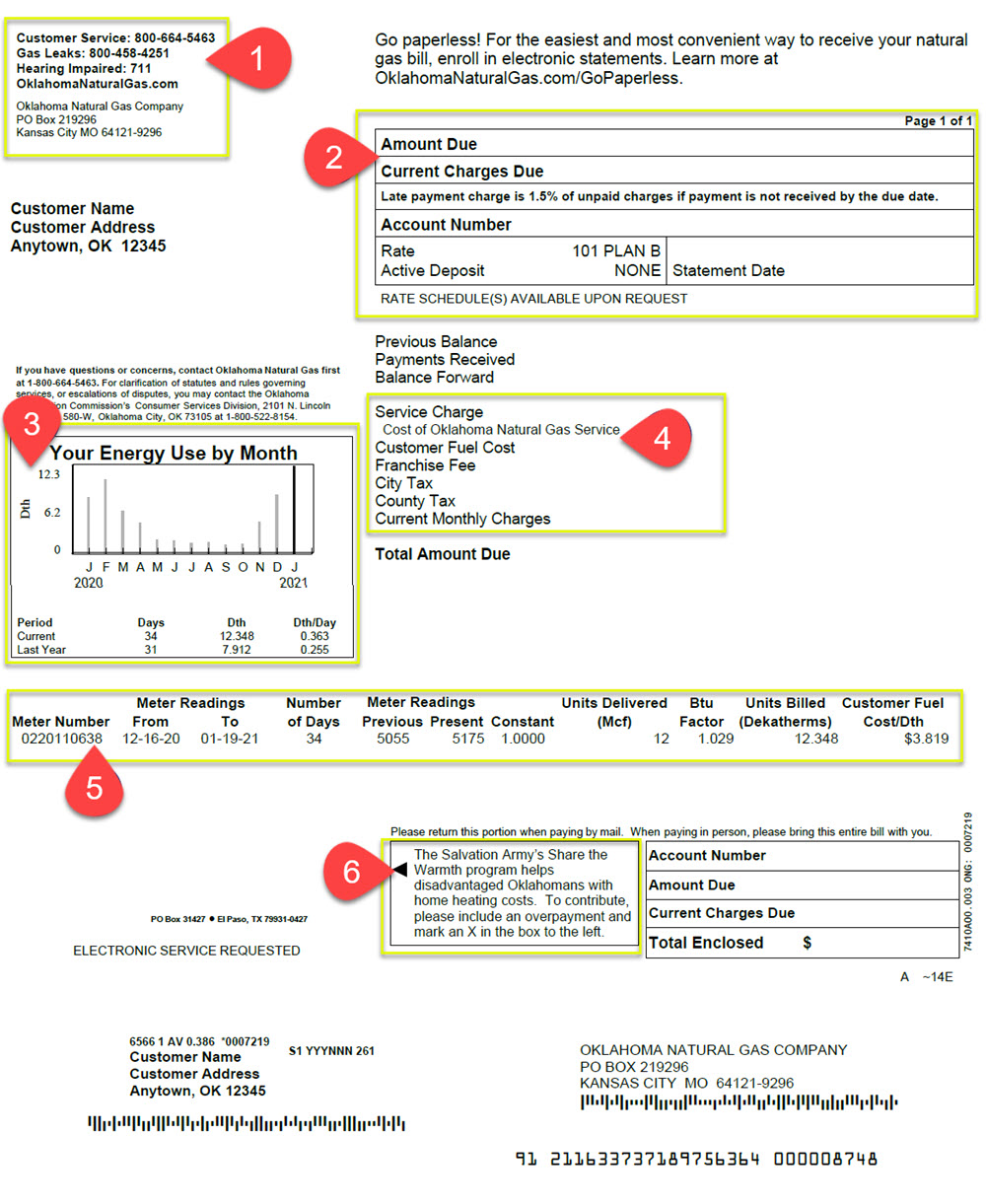

Oklahoma Natural Gas Understand Your Bill

Oklahoma Taxpayer Access Point

Trifold Brochure For Two Men And A Truck Trifold Brochure Moving Company Brochure

Oklahoma Tax Commission Oktaxcommission Twitter

Want To Run Your Own Tag Agency Now S Your Chance

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Comics

Incorporate In Oklahoma Do Business The Right Way

Oklahoma Tax Commission Oktaxcommission Twitter

The 2021 Tax Filing Deadline Is Extended For Texas Oklahoma And Louisiana Residents Taxact Blog